Now we will perform LDA on the Smarket data. In R, we fit a LDA model

using the lda() function, which is part of the MASS library.

Notice that the syntax for the lda() function is identical to that of lm(),

and to that of

glm() except for the absence of the family option. We fit the model using

only the observations before 2005.

> library(MASS)

> library(ISLR2)

> attach(Smarket)

> train <- (Year < 2005)

> lda.fit <- lda(Direction ~ Lag1 + Lag2, data = Smarket, subset = train)

> lda.fit

Call:

lda(Direction ~ Lag1 + Lag2, data = Smarket, subset = train)

Prior probabilities of groups:

Down Up

0.491984 0.508016

Group means:

Lag1 Lag2

Down 0.04279022 0.03389409

Up -0.03954635 -0.03132544

Coefficients of linear discriminants:

LD1

Lag1 -0.6420190

Lag2 -0.5135293

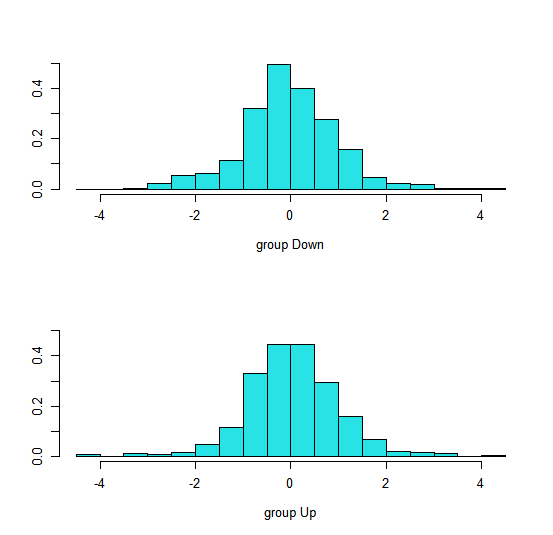

> plot(lda.fit)

The LDA output indicates that \(\hat\pi_1 = 0.492\) and \(\hat\pi_2 = 0.508\) ; in other words,

49.2% of the training observations correspond to days during which the

market went down. It also provides the group means; these are the average

of each predictor within each class, and are used by LDA as estimates

of \(\mu_k\). These suggest that there is a tendency for the previous 2 days’

returns to be negative on days when the market increases, and a tendency

for the previous days’ returns to be positive on days when the market

declines. The coefficients of linear discriminants output provides the linear

combination of Lag1 and Lag2 that are used to form the LDA decision rule.

In other words, these are the multipliers of the elements of \(X = x\) in

(4.19). If -0.642×Lag1-0.514×Lag2 is large, then the LDA classifier will

predict a market increase, and if it is small, then the LDA classifier will

predict a market decline. The plot() function produces plots of the linear

discriminants, obtained by computing −0.642 × Lag1 − 0.514 × Lag2 for

each of the training observations.

Try modifying the current lda model by adding the Lag3 variable:

Assume that:

- The

ISLR2andMASSlibraries have been loaded - The

Smarketdataset has been loaded and attached