We will begin by examining some numerical and graphical summaries of

the Smarket data, which is part of the ISLR2 library. This data set consists of

percentage returns for the S&P 500 stock index over 1, 250 days, from the

beginning of 2001 until the end of 2005. For each date, we have recorded

the percentage returns for each of the five previous trading days, Lag1

through Lag5. We have also recorded Volume (the number of shares traded

on the previous day, in billions), Today (the percentage return on the date

in question) and Direction (whether the market was Up or Down on this

date).

> library(ISLR2)

> names(Smarket)

[1] "Year" "Lag1" "Lag2" "Lag3" "Lag4" "Lag5"

[7] "Volume" "Today" "Direction"

> dim(Smarket)

[1] 1250 9

> summary(Smarket)

Year Lag1 Lag2 Lag3

Min. :2001 Min. :-4.922000 Min. :-4.922000 Min. :-4.922000

1st Qu.:2002 1st Qu.:-0.639500 1st Qu.:-0.639500 1st Qu.:-0.640000

Median :2003 Median : 0.039000 Median : 0.039000 Median : 0.038500

Mean :2003 Mean : 0.003834 Mean : 0.003919 Mean : 0.001716

3rd Qu.:2004 3rd Qu.: 0.596750 3rd Qu.: 0.596750 3rd Qu.: 0.596750

Max. :2005 Max. : 5.733000 Max. : 5.733000 Max. : 5.733000

Lag4 Lag5 Volume Today

Min. :-4.922000 Min. :-4.92200 Min. :0.3561 Min. :-4.922000

1st Qu.:-0.640000 1st Qu.:-0.64000 1st Qu.:1.2574 1st Qu.:-0.639500

Median : 0.038500 Median : 0.03850 Median :1.4229 Median : 0.038500

Mean : 0.001636 Mean : 0.00561 Mean :1.4783 Mean : 0.003138

3rd Qu.: 0.596750 3rd Qu.: 0.59700 3rd Qu.:1.6417 3rd Qu.: 0.596750

Max. : 5.733000 Max. : 5.73300 Max. :3.1525 Max. : 5.733000

Direction

Down:602

Up :648

The cor() function produces a matrix that contains all of the pairwise

correlations among the predictors in a data set. The first command below

gives an error message because the Direction variable is qualitative.

> cor(Smarket)

Error in cor(Smarket): 'x' must be numeric

> cor(Smarket[, -9])

Year Lag1 Lag2 Lag3 Lag4 Lag5

Year 1.00000000 0.029699649 0.030596422 0.033194581 0.035688718 0.029787995

Lag1 0.02969965 1.000000000 -0.026294328 -0.010803402 -0.002985911 -0.005674606

Lag2 0.03059642 -0.026294328 1.000000000 -0.025896670 -0.010853533 -0.003557949

Lag3 0.03319458 -0.010803402 -0.025896670 1.000000000 -0.024051036 -0.018808338

Lag4 0.03568872 -0.002985911 -0.010853533 -0.024051036 1.000000000 -0.027083641

Lag5 0.02978799 -0.005674606 -0.003557949 -0.018808338 -0.027083641 1.000000000

Volume 0.53900647 0.040909908 -0.043383215 -0.041823686 -0.048414246 -0.022002315

Today 0.03009523 -0.026155045 -0.010250033 -0.002447647 -0.006899527 -0.034860083

Volume Today

Year 0.53900647 0.030095229

Lag1 0.04090991 -0.026155045

Lag2 -0.04338321 -0.010250033

Lag3 -0.04182369 -0.002447647

Lag4 -0.04841425 -0.006899527

Lag5 -0.02200231 -0.034860083

Volume 1.00000000 0.014591823

Today 0.01459182 1.000000000

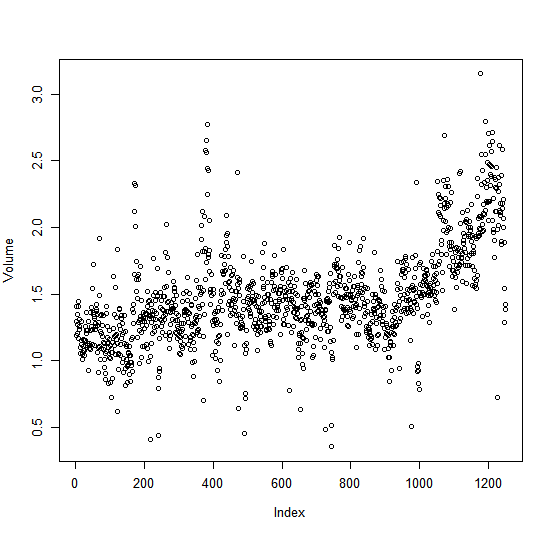

As one would expect, the correlations between the lag variables and today’s returns are close to zero. In other words, there appears to be little correlation between today’s returns and previous days’ returns. The only substantial correlation is between Year and Volume. By plotting the data we see that Volume is increasing over time. In other words, the average number of shares traded daily increased from 2001 to 2005.

attach(Smarket)

plot(Volume)